From VC Fund to Syndicate: The Pivot That Changed Everything

The advice was brutal but necessary: Stop messing around and go do some actual deals.

Seven weeks ago, I had a plan to raise a $15 million venture capital fund focused on early-stage food and beverage CPG brands. I had the ambition, the vision, and the passion but I'd never actually done venture capital before.

After speaking with several generous, currently-operating general partners at established VC funds, they all gave me the same reality check: prove yourself first. Don't try to build a fund from scratch when you've never placed a bet on a founder.

It reminded me of advice I'd give to someone who wants to build "the largest, coolest, trendiest coffee shop that has ever existed" but has never owned one before. I'd tell them: get an espresso machine, a small one, or grab a kettle and a Chemex, and go pop up somewhere. Go to a farmers market, pay the small fee, and get the firsthand experience of actually selling coffee to people.

Do the work before you build the empire.

This time, I'm actually listening.

Ask my wife… I'm a terrible listener. Not because I don't hear, but because I tend to do things my way regardless of advice. That worked when I was younger and had fewer scars to show for it. But now, with years of both great and terrible business experiences behind me, I sought advice from people doing exactly what I want to do and I'm going to learn from it and execute.

Thirsty Friends: A New Kind of Investment Community

Thirsty Friends has evolved into a syndicate: a group of investors who pool resources to back early-stage food and beverage brands that are creating category-disrupting products. This isn't about paying fees to join some exclusive club. You just join. If a deal excites you, you can invest. You do need to be an accredited investor (the platform walks you through verification), but once you're in, you can invest $1,000, $5,000, $10,000 or whatever feels right for you.

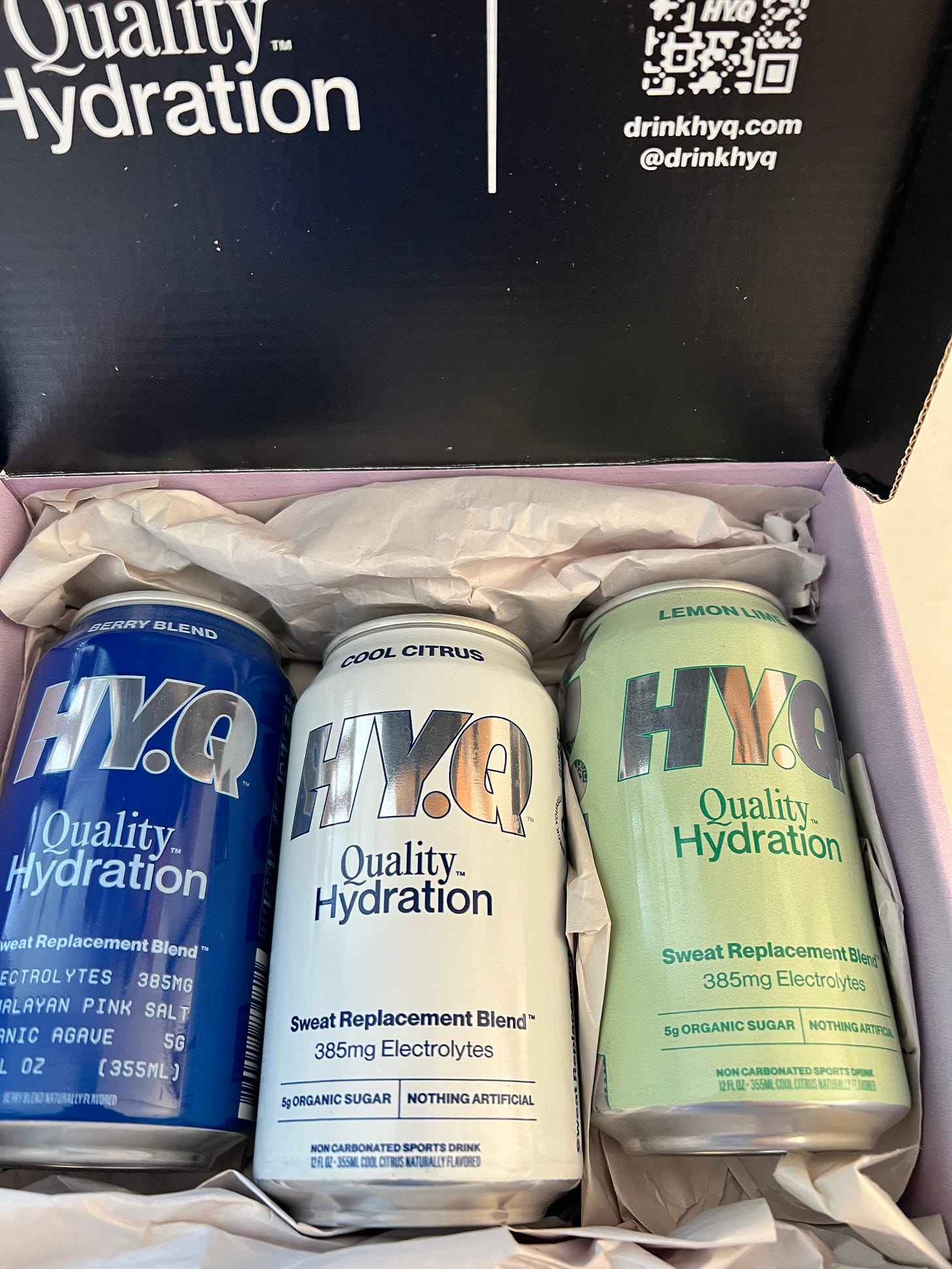

I've been reaching out to founders building brands and products that obsess me. The ones creating products that change how we think about and do things. Sure, I love legacy products too (I'm a sucker for a Coke, though I drink far less of it now), but I want to find the products that will become tomorrow's legacy brands because the world embraces them.

The Vision: Beyond Just Capital

Here's what gets me excited: if our community grows large enough, brands will come to us specifically for real market feedback from a consumer perspective… and capital. We want to be a place that can fund ideas without being a corporate behemoth that runs endless diligence. I want to place bets on people.

If you've never built something from scratch, you don't really understand the sheer amount of effort, energy, and angst management required. You have to block out noise, take feedback without it crushing your soul (really, really difficult), and believe you're capable of doing something that most people want to do but never actually execute because they get lost in outcomes instead of getting lost in the work.

If you're not ready to be in the arena but still want to be part of building something meaningful, that's what Thirsty Friends offers. We can all do this together.

The syndicate model lets us move fast, place smart bets on passionate founders, and build a community around products we genuinely believe will shape the future of food and beverage. No bureaucracy, no endless committees—just people who love discovering and supporting the next generation of category creators.

Ready to join? Visit thirstyfriends.com and let's find these deals together.